Alvexo Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €500

- MT4

- Alvexo WebTrader

- FSA

- CySEC

- 2005

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €500

- MT4

- Alvexo WebTrader

- FSA

- CySEC

- 2005

Our Evaluation of Alvexo

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Alvexo is a broker with higher-than-average risk and the TU Overall Score of 4.48 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Alvexo clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Alvexo is a broker that is available for self-training and self-trading.

Brief Look at Alvexo

Alvexo is a CFD broker that has been providing services since 2014. The company offers CFD trading on 6 asset classes, including currency pairs, stocks, bonds, commodities, indices, and cryptocurrencies.

The Alvexo brand is a trademark owned by HSN Capital Group Ltd, which is controlled and regulated as a securities dealer by the Seychelles Financial Services Authority (FSA), License number SD030 . In addition to the Seychelles office, the company also has a Cyprus division which is regulated by CySEC 236/14 and targets European clients.

- A wide range of trading instruments.

- In addition to the popular MetaTrader 4 platform, the proprietarily developed Alvexo WebTrader is available to clients.

- Additional Alvexo Plus services are available, such as Trading Central trading signals, webinars, and TV news.

- A powerful training program that includes courses in its own Academy, webinars from professionals, and e-books.

- A wide range of methods to replenish and withdraw funds.

- There are no PAMM or MAM accounts for passive investing.

- Very slow replies from the support team.

- Regulation from offshore jurisdictions.

TU Expert Advice

Financial expert and analyst at Traders Union

Alvexo, a CFD broker, has been providing services for over six years while offering global clients four types of accounts: Classic, Gold, Prime, and Elite.

The minimum deposit is €500 for a Classic account. Trading conditions differ depending on the type of account, the larger the deposit, the more advantageous are the spreads. For example, on a Classic account, the minimum spread is 2.9 pips, but on an Elite account, spreads begin at 0.1 pips. However, to open such an account, you need to negotiate individually.

Details of the current spreads, commissions, and other costs for each underlying instrument are posted on the Alvexo website. The most complete information is contained in PDF documents, which can be downloaded from the sections labeled Terms & Conditions, and Legal Documents. Detailed terms of trading accounts can be checked with technical support specialists. Online chat operators take a long time to answer, so we recommend a lot of patience. The broker provides virtual landline phone numbers in 14 countries.

Alvexo Summary

| 💻 Trading platform: | МТ4 (desktop, mobile), Alvexo WebTrader |

|---|---|

| 📊 Accounts: | Classic, Gold, Prime, Elite |

| 💰 Account currency: | USD, EUR |

| 💵 Replenishment / Withdrawal: | International bank transfer, credit/debit card, PayPal, Skrill, PaysafeCard |

| 🚀 Minimum deposit: | From €500 |

| ⚖️ Leverage: | Up to 1:300 (on all accounts) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Minimum spread for EUR/USD is 2.9 pips (for Classic) |

| 🔧 Instruments: | Currency pairs (60+), CFDs on stocks (350+), Indices (15), Commodities (12), Cryptocurrencies (13), Bonds |

| 💹 Margin Call / Stop Out: | 50%/15% |

| 🏛 Liquidity provider: | Banks and partners |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | There is an inactivity fee on all accounts |

| 🎁 Contests and bonuses: | Yes |

The Alvexo broker offers clients more than 450 instruments for trading, the classic MetaTrader 4 terminal, as well as its own Alvexo WebTrader terminal, and the ability to choose from four types of accounts. Depending on the type of account chosen, clients may use personal consultations with a company specialist, leverage up to 1:300, and Alvexo Plus services (signals, training programs). Potential clients can test the trading conditions on demo accounts. Muslim traders can use Islamic accounts (without charging swaps) after a request to the support service.

Alvexo Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with Alvexo, you need to become a client of the broker by opening a trading account. The registration process is very simple. A quick guide looks like this:

On the Alvexo website, click Sign Up.

The system will open a registration form where you need to enter your personal data (full name, email address, complex password). For convenience, you can use your Facebook, Google, or Apple accounts.

After registration, you will need to select the type of account (demo or real), as well as indicate your phone number. After that, you will be redirected to the WebTrader trading platform, which includes the functionality of your personal account. By default, the account replenishment form opens.

You can skip the deposit step and go to the main window of the WebTrader platform. To use all the functions, you will need to upload two documents to the system to confirm your identity and address of residence.

Alvexo personal account features:

In the personal account, the trader has access to:

-

Functions for managing accounts.

-

Functions for editing personal data.

-

Functions for replenishment/withdrawal of funds.

-

Language and light/dark theme settings.

-

Access to the service of trading signals, Financial TV, news.

-

Access to reference materials.

-

Access to support requests.

Regulation and Safety

Alvexo is regulated by the Seychelles Financial Services Authority, license number SD030. The cooperation of a separate Cypriot division with the regulation of the European jurisdiction CySEC increases the reliability of the company.

Alvexo ensures platform integrity and customer confidentiality through the use of modern security protocols. Transactions and trades are protected with 256-bit RapidSSL encryption, and the entire system is carefully protected by a security firewall. Transactions are handled by the highest PCI-certified service providers, and the servers are located in SAS-70 certified data centers.

Advantages

- Client funds are separated from Alvexo's capital and held in segregated bank accounts

- Negative balance protection is active

- Sufficient choice of electronic payment systems for making deposits and withdrawals

Disadvantages

- The broker does not provide transparent information about commissions for deposits and withdrawals

- Regulation is from an offshore jurisdiction

- There is no possibility to set up two-factor authentication

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Classic | $29 | Depends on the method |

| Gold | $22 | Depends on the method |

| Prime | $18 | Depends on the method |

| Elite | $1 | Depends on the method |

There are swap fees (commissions for transferring a position to the next day), the values are constantly updated, check with the support service for the current values.

The analysts of the Union also compared the size of the average trading commission of Alvexo, RoboForex, and FxPro. The comparative results are presented in the form of the below table.

| Broker | Average commission | Level |

|---|---|---|

|

$17.5 | |

|

$1 | |

|

$8.5 |

Account Types

In the updated line of accounts for corporate and individual clients, the Alvexo broker offers four types of accounts. The trading leverage is up to 1:300 and is available on all accounts, depending on the instrument.

Account types:

Demo accounts are available for all terminals. When you open a demo, the broker allows you 50 thousand virtual euros.

Alvexo is a broker that provides ample opportunities for novice traders.

Deposit and Withdrawal

-

Alvexo processes a withdrawal request within 24 hours during business hours.

-

Money can be withdrawn to Visa and Mastercard (debit and credit), bank transfer, using payment systems such as PayPal, Skrill, and PaySafeCard.

-

The minimum withdrawal amount is $100.

-

Withdrawals take 4 to 7 business days.

-

Verification is optional to be able to make a deposit.

-

The site does not have a page dedicated to the deposit/withdrawal of funds.

Investment Programs, Available Markets and Products of the Broker

At the moment, the Alvexo broker does not offer any methods to create passive income. PAMM or MAM accounts and social trading services are not available to clients.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Alvexo’s affiliate program:

-

An affiliate program from Alvexo is a rational solution for those who want to convert their traffic into growing income. To popularize its affiliate program, the broker has created a special site alvexopartners.com.

The Broker's affiliates can receive individual rewards for attracting new clients with quick payouts in a convenient way. The broker uses modern technologies to make the process transparent and increase conversions and also provides its affiliates

with marketing tools and advice from a specialized support service that works 24/5.

Customer Support

Support operators are available from 9:00 am to 6:00 pm Cyprus time, Monday through Friday.

Advantages

- In the online chat, you may ask a question without being a client of the company

- There are many regional virtual landlines

Disadvantages

- Open 9 to 5, 5 days a week

- Very long answers from experts in the chat

This broker provides the following communication channels for its clients:

-

telephone;

-

email;

-

online chat;

-

feedback form.

The broker's website also offers regional virtual landline numbers that you can call free of charge from these countries: Argentina, Brazil, Chile, Colombia, Malaysia, Mexico, Panama, Peru, Cyprus, Great Britain, United Arab Emirates, South Africa, and Switzerland.

Not only a registered client but also a site visitor without an active account can ask a broker's representative a question.

Contacts

| Foundation date | 2005 |

|---|---|

| Registration address | HIS Building, Office 5, Providence, Mahe, Seychelles. |

| Regulation | FSA, CySEC |

| Official site | https://www.alvexo.com/ |

| Contacts |

+442037698180

+35725262686 +24825030482 |

Education

The Alvexo website has a dedicated Trading Academy section with training materials. Materials from the Academy are broken down by difficulty levels such as Basics and Advanced. However, to access all the materials, you need to have a registered account.

The broker regularly holds webinars for beginners, which can then be watched in the recording. The broker's Youtube channel has over 1.5 thousand subscribers. Alvexo is one of the few brokers that organizes large-scale events offline. So, in 2020, under the auspices of Alvexo, a financial conference was held in Dubai, where experts discussed the markets for gold, oil, and relevant financial assets.

Comparison of Alvexo with other Brokers

| Alvexo | RoboForex | Pocket Option | Exness | Eightcap | Tickmill | |

| Trading platform |

Alvexo WebTrader, MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MT5, Tickmill Mobile App |

| Min deposit | $500 | $10 | $5 | $10 | $100 | $100 |

| Leverage |

From 1:1 to 1:300 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 2.9 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 5% | 60% / 40% | 30% / 50% | No / 60% | 80% / 50% | 100% / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of Alvexo

The Alvexo broker bases its work on the observance of three rules: a wide selection of markets, quick account opening, and maximum useful information for beginners. Islamic and demo accounts are available for traders.

Alvexo by the numbers:

-

More than 170 thousand user registrations.

-

More than 300 thousand positions are open.

-

More than $19 billion in trades completed.

Alvexo is a broker for active individual trading

The broker does not disclose information about affiliates, liquidity providers, or server locations. There are no statistics on slippage and order execution speed on the broker's website.

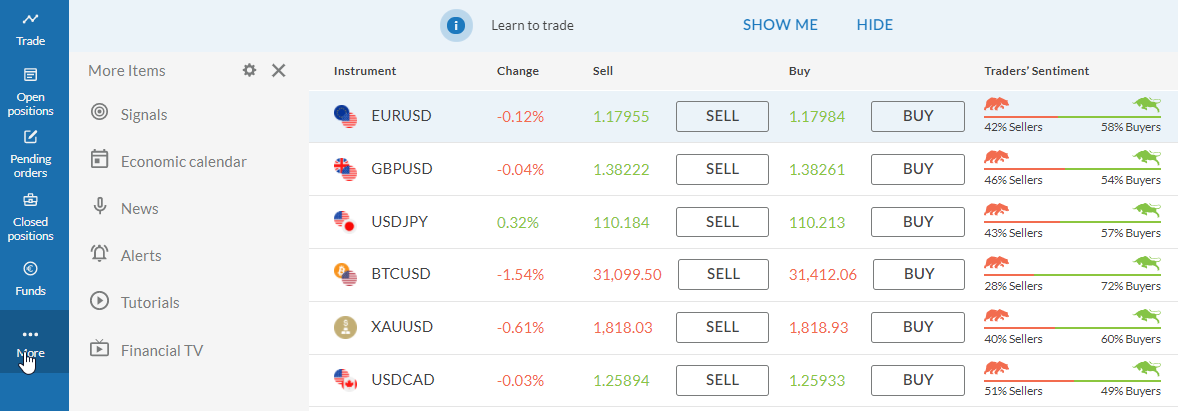

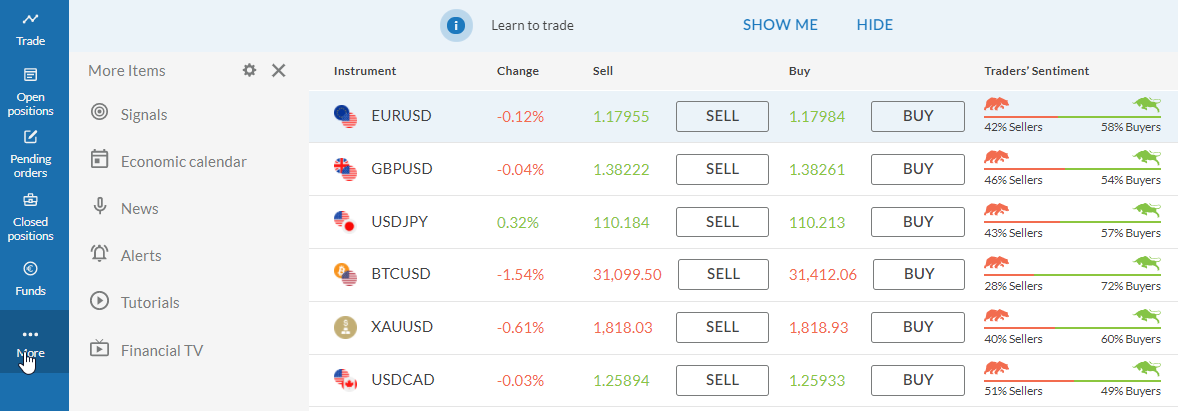

Alvexo’s clients trade through MetaTrader 4 desktop and mobile terminals. The Alvexo WebTrader platform with an integrated user account is also available. The ability to connect your own advisors/scripts to Alvexo WebTrader is not available, but the ability to do so is available on MT4.

Useful services of the Alvexo broker:

-

Sentiment. An indicator of market sentiment that helps traders to determine the direction of the trend.

-

Signals. Trading ideas from Trading Central are built into the trading terminal.

-

Alerts. Ability to customize notifications when the price reaches preset values.

-

Economic calendar. Helps market participants to be ready for important macroeconomic news.

-

News and Financial TV. A quick overview of the top news and trading ideas on how to trade using the news.

Advantages:

There are six asset classes available for trading.

To ensure the safety of client funds, the company stores them in segregated accounts.

Negative balance protection is active.

Tight spreads on Elite account.

The broker provides analytics as well as innovative tools to improve the quality of trading.

All accounts can be converted to the Islamic format. Clients can open demo accounts without restrictions.

User Satisfaction